Concept of Market Profile was created at Chicago Board of Trade (CBOT) by trader Peter Steidlmayer and first published during the 1980s as CBOT product.

Market profile by itself is not a stand-alone strategy, but a different way how you can view the market and make better trading decisions.

They have seen a market as an auction process which is affected by supply and demand the same way as every other auction, for example, development of prices of food, gas etc.

The price goes up as long there are buyers in the market who are willing to buy at higher prices. The price goes up until there is at least one buyer who is willing to buy at a particular price level.

The opposite scenario is happening when the price is going down, the market is trying to lure in sellers willing to sell at lower price levels which are attractive for buyers.

With this simplified description, it is important to realize that in each transaction, there has to be one trader buying and one selling at the same time for the market to move.

When the price is going up or down, there is no supremacy on either side, but the amount of aggressivity or willingness to buy/sell for higher/lower prices.

The next factor which creators of Market Profile consider is the fact that the market is lead by repeating patterns in the behaviour of market participants, which are the same at all different markets such as stocks, futures or forex.

This means that Market Profile is applicable to every market of your choice.

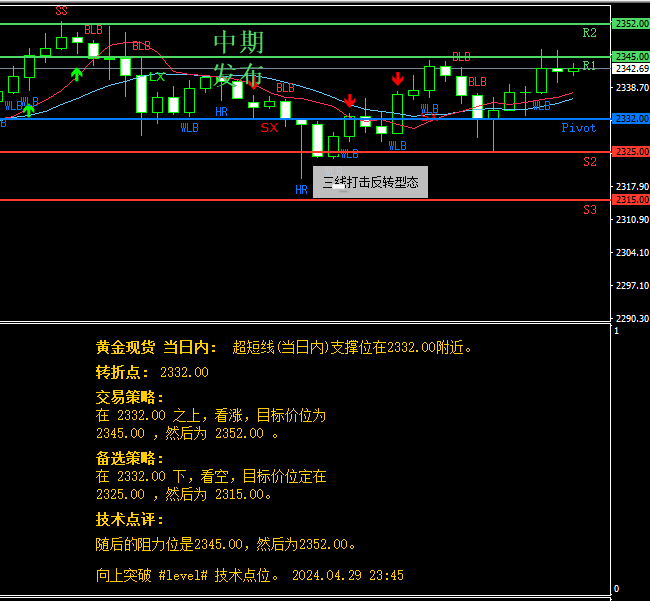

Support and Resistance Levels

The first thing that most traders will use market profile for is identifying basic support and resistance levels. It is important to note that using Market Profile as an identifier for support and resistance levels is a reactive method. This means that unlike proactive methods (such as trend lines and moving averages) which are based on current price action and analysis to predict future price movements, reactive methods rely on past price movements . Reactive methods can be useful in applying meaning or significance to price levels where the market has already visited. Basic technical analysis has shown that a support level is a price level which will support a price on its way down and a resistance level is a price level which will resist price on its way up. Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of price is a good indication of a support level. The opposite is also true. A price level near the top of the profile which heavily favors sell side volume is a good indication of a resistance level.

Example strategy

Just like with most other tools or studies, Market Profile has a number of uses. There are many trading strategies out there using Market Profile as a key component. Below are the basics of one such strategy which is based on comparing the current day’s opening price to the previous day’s Market Profile.

- If the current day opens above the previous day’s value area (but still below the Profile High) look for price to retrace back towards the Point of Control and then proceed to rise (the direction of the day’s open). Therefore during the retracement to the Point of Control, there is a buying opportunity.

- If the current day opens below the previous day’s value area (but still above the Profile Low) look for price to retrace back towards the Point of Control and then proceed to fall (the direction of the day’s open). Therefore during the retracement to the Point of Control, there is a selling opportunity.

- If the current day’s opening price is completely outside of the previous day’s profile (above the Profile High or below the Profile Low) this can be seen as a possible runner in the direction of the opening price relative to the previous day’s profile range.