We present to you a new development for trading the EURGBP currency pair.

The idea for this robot arose from a study of trading of another popular market product. Its weaknesses were discovered – trading only in the direction of purchases and significant drawdowns due to averaging of positions.

Our bot does not have these very serious shortcomings and does not use martingale. Each position is protected by a short stop loss.

This bot has no relation to another popular product and does not use its algorithms. The only thing that was borrowed was the EURGBP currency pair, which allowed for a detailed study of possible patterns. These patterns were found thanks to data mining and painstaking work to improve trading performance.

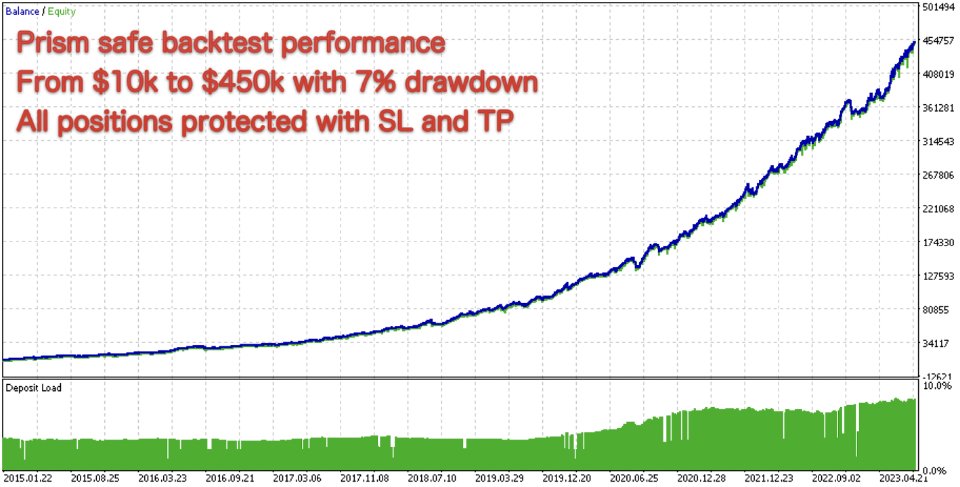

The algorithm is based on several unique strategies, each of which analyzes a specific group of patterns. It works well on M15 and H1 timeframes. The robot has shown high stability from 2015 to the present. And even until 2015 it retains its statistical properties.

Recommendations:

- Currency pair EURGBP

- Timeframes: M15, H1

- Minimum deposit: $50 usd

- Account type: Hedging

Characteristics:

- Built-in effective strategies that do not require optimization

- Allow BUY: Allows buy positions

- Allow SELL: Allows sell positions

- Progressive lot coefficient: Progressive lot multiplier. Increases the lot when equity increases and decreases when there are drawdowns

- Fixed lot, set 0 if progressive: Fixed lot, if equal to zero then progressive is used

- Max positions number: Can open several positions, limits their maximum number

- Time delay between positions: how many hours EA must wait until next signal

- Max spread: EA will trade if the current spread less then this parameter

If you are a new trader, please read carefully! Trading on the FOREX market involves high risks. In order to save the deposit, carefully monitor and do not overestimate them. Risks are caused by both the volatility of markets and the volatility of brokers’ trading conditions. First, test the product in the strategy tester with different settings and use optimization to choose the settings that suit you. Make sure all settings are correct and set the minimum acceptable lot before starting to familiarize yourself with this product. Once you are confident that everything is set up and working correctly, control the volume of positions, but do not overestimate it. You should not trade “all in”; try to use a more reasonable approach by monitoring the quality of the trade.