[Development concept]

“Portfolio Algorithm Trading” is EA developed with the highest priority on robustness.

Following can prove that this EA is not over-optimized

- Backtest have good performance on 30,278 trades(14 years)

- It can work well at any currency pairs if you apply same parameters.

- It can work well if you change parameter back and forth.

- 1 year forward test was same as backtest.

[Features]

This EA is not used kind of martingale, averaging and grid.

Weekend risk and minus swap are not effected because all positions will be closed before NY time.

My recommended setting as below use 50 charts with 10 currency pairs x 5 parameters. This purpose is diversification.

For further diversification, it has two positions on each chart, one takes profit with fixed pips, the other one extend profit with Trailing Stop.

[Recommended settings]

I recommend that you built a portfolio consisted of 10 currency pairs x 5 parameters.

Currency Pairs : EURUSD / GBPUSD / USDJPY / USDCHF / GBPJPY / AUDJPY/ CHFJPY / EURJPY / CADJPY / EURCAD

5 parameters:LA_Value 3550, 3615, 3680, 3745, 3810 (Explanation of this parameter is written in below parameter explanation table.)

So There are 50 charts.

You can set easily recommended portfolio by applying profiles which can download from below link.

https://drive.google.com/file/d/1yeyy6irLvBI_UCaEAvYeBT1141Sedi4E/view?usp=sharing

The method of portfolio setting by profiles is following. You must finish download of EA before following action.

- Select “Open Data Folder” from the File tab and open the “profiles” folder.

- Paste downloaded “Portfolio Algorithm Trading” to the opened “profiles” folder (Please paste unzip file).

- Restart MT4.

- Select “Profiles” from the File tab, and select “Portfolio Algorithm Trading”.

- Select “Options” from the tools tab and set 2000 into “Max bars in history” and “Max barsin chart” to make operation smooth.

Finally, Time frame of all 50 charts are 1H.

If you have any problems, please contact me freely.

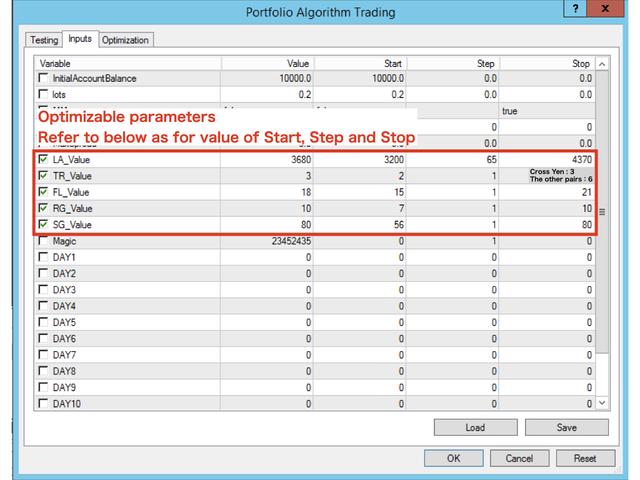

[Parameter explanation]

If you set up portfolio by yourself, please do backtest or optimization by referring to following explanation of parameters or screenshot.

(However, in my recommended settings, I apply same parameters to all currency pairs on purpose to avoid over-optimization. Please kept it in your mind.)

| Parameter | Contents | Default |

|---|---|---|

| InitialAccountBalance | Initial account balance. This vale is used to calculate lot size when you select MM is true | 10000 |

| lots | Lot size | 0.2 |

| MM | When you make this “true”, compound interest is applied | false |

| Slippage | Slippage acceptance | 10 |

| MaxSpread | Spread acceptance | 3 |

| LA_Value | This is parameter to adjust entry timing. If you change this parameter, v alue range should be from 3200 to 4370. |

3680 |

| TR_Value | This is parameter to limit trading time. If currency pair don’t include JPY, this value is from 2 to 6. If currency pair include JPY, this value is from 2 to 3 |

3 |

| FL_Value | This is parameter for filter. Value range is from 15 to 21 | 18 |

| RG_Value | This is parameter for take profit. Value range is from 7 to 10 | 10 |

| SG_Value | This is parameter for loss cut. Value range is from 56 to 80 | 80 |

| Magic | Magic No. | 23452435 |

| DAY1〜10 | You can set no trading day of year. Value range is from 1 to 365 | 0 |

| STARTDAY | You can set start trading day of year. Value range is from 1 to 365 | 6 |

| ENDDAY | You can set end trading day of year. Value range is from 1 to 365 | 356 |

| Manual_GMT_Adjust | If you select false, GMT time is adjusted automatically. But I recommend that you adjust by yourself. Because that is more precise method. So my recommendation is true. |

true |

| Manual_GMT_Winter | If you select “Manual_GMT_Adjust” is true, please input GMT time at winter on your broker MT4 time. | 2 |

[Back test]

You can check back test report from bottom of screenshot. 50 parameter set results are combined.

Condition is following.

Period:2005-2018

Lot size: 0.1 Lot

Spread:EURUSD / USDJPY = 2 pips, AUDJPY / EURJPY / USDCHF = 2.5 pips, The others = 3 pips

According to the report, annual average profit was $7,791 , maximum drawdown was $3,856 and profit factor(PF) was 1.89.

[Forward test]

You can check 1 year forward test from screenshot. This is demo trading.

Performance is very similar to back test as you can see screenshot.

![图片[1]-Mql5官网 Portfolio Algorithm Trading 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240518030430-66481abed0da3.png)

![图片[2]-Mql5官网 Portfolio Algorithm Trading 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240518030431-66481abfc95c5.png)

![图片[3]-Mql5官网 Portfolio Algorithm Trading 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240518030432-66481ac0b5c13.png)