FREE

DOWNLOAD

Understanding Support & Resistance

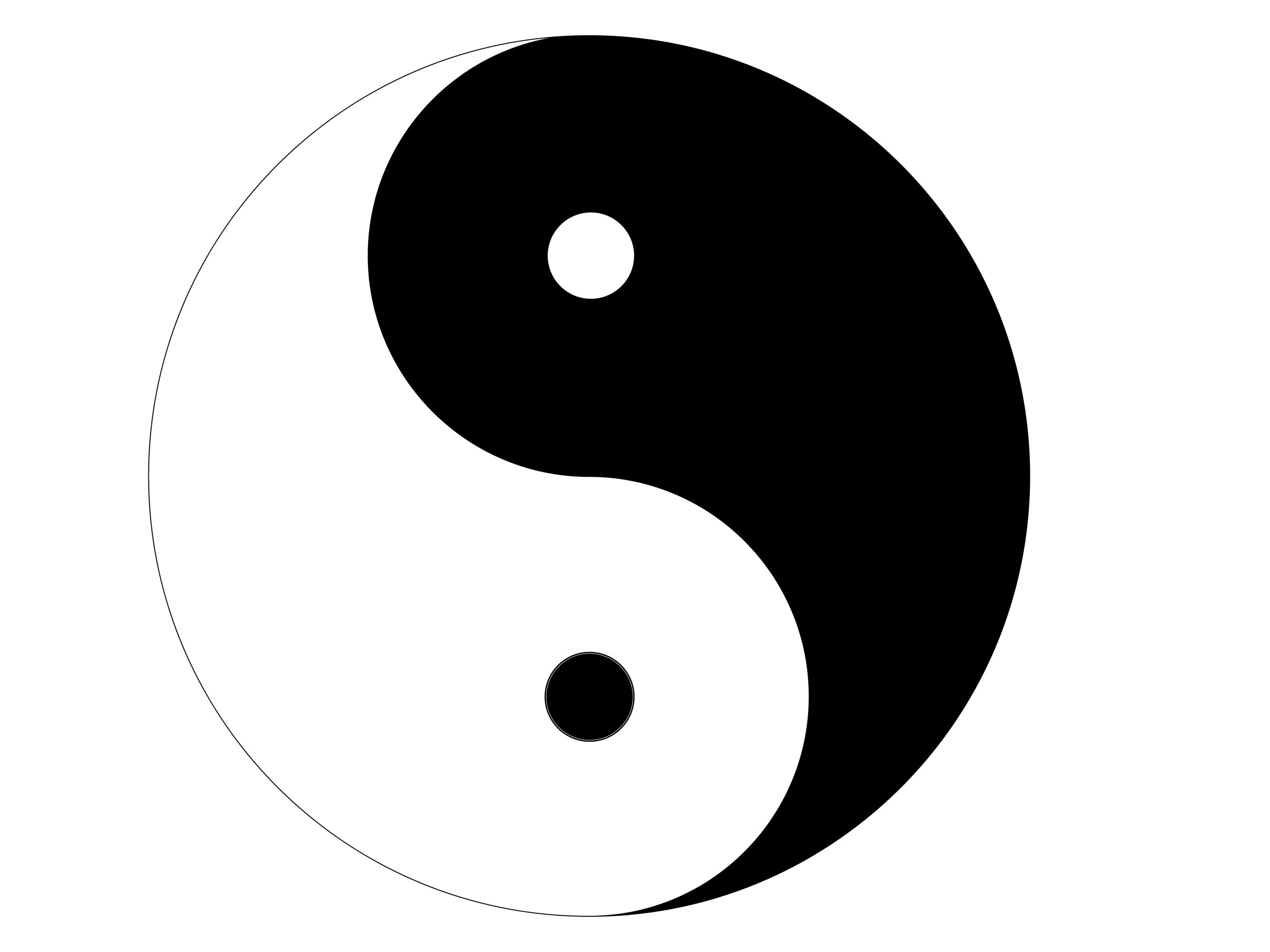

Support and Resistance are critical levels used by market participants in making decisions. This level is used to determine whether the price

will continue or reverse direction. If this Support and Resistance is combined with candlestick forms, it is believed that it will be able to

determine the next movement.

Economic support can be interpreted as a level where supply begins to decrease and demand increases so that if that happens, prices will rise at that

level.

In principle, if the market price breaks the support level, then the market price is expected to continue decreasing to the next support

level.

However, if the market price is unable to break through this level, the market price will reverse. A broken support level can become a resistance

level and hold the market price up.

Economic resistance can be interpreted as a level where supply is too much and demand has begun to decrease so that market prices will fall at that

level.

If the market price manages to rise and penetrate the resistance level, it is estimated that market prices will continue to rise to the next

resistance level. The resistance level that has been broken will become a support and can hold the market to go down past that level.

To be able to recognize support and resistance, you inevitably have to learn to observe forex charts.

Slow down, no need to rush.You can do it.

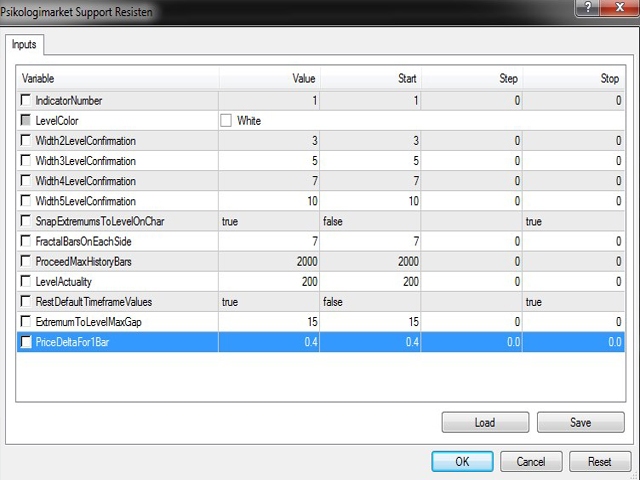

Determine Support and Resistance

After understanding the meaning of support and resistance, now is the time for you to determine that support and resistance. Did you know that

there are many ways to determine support and resistance?

Let’s discuss them one by one.

Highest Point (Top) or Lowest Point (Bottom)

![图片[1]-Mql5官网 SNR Support Resistance 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240518034316-664823d46df19.jpg)