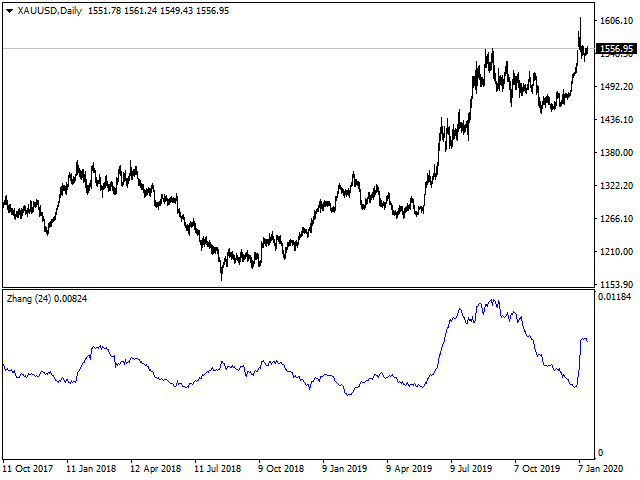

In finance, volatility (symbol σ) is the degree of

variation of a trading price series over time as measured by the

standard deviation of logarithmic

returns.

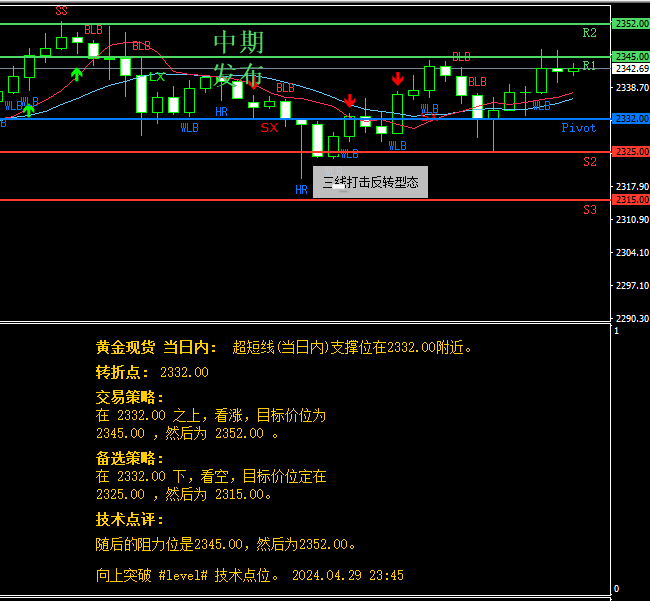

Historic volatility measures a time series of past market prices. Implied

volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option).

In 2000 Yang-Zhang created a volatility measure that handles both opening jumps and drift. It is the sum of the overnight volatility

(close-to-open volatility) and a weighted average of the Rogers-Satchell volatility and the open-to-close volatility. The assumption

of continuous prices does mean the measure tends to slightly underestimate the volatility –

https://www.jstor.org/stable/10.1086/209650?seq=1#metadata_info_tab_contents

For using from within an Expert Adviser, call the indicator with

iCustom(NULL,0,”ZhangHistoricalVolatility”,24,0,0);

![图片[1]-Mql5官网 Zhang Historical Volatility Indicator 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240518052330-66483b52b49c0.png)