YOUR IDEAL AVERAGE Worker Place BUY and SELL LIMIT pending orders on AVERAGE line so it would be moved on opening of any candle! NOW

YOU CAN do this on any kind of an AVERAGE available in MetaTrader. EA manages a scenario of an AVERAGE CROSSING.

EA WORKS ON ANY INTERVALL. The chart interval determines what kind of candles will EA base upon its actions.

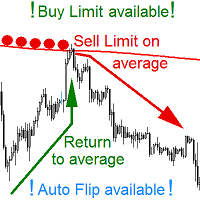

EA places LIMIT pending order (Buy or Sell Limit) on ANY MOVING AVERAGE that is available in MetaTrader Platform. After placement EA

moves a pending order on every candle opening. Order has specified SL, BE, TP levels, which are also adjusted along with the order price

level change on any candle opening.

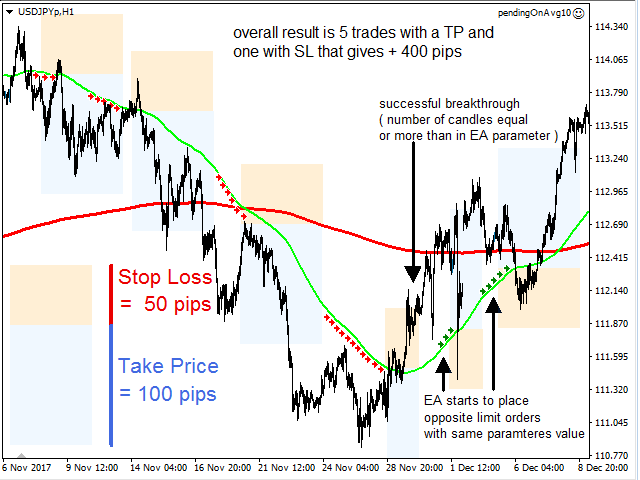

EA manages an average crossing scenario – if price breaks through the specified average, EA places an opposite pending order on the same

average after given number of candles have closed during the time price was on the opposite side of the average. E.g. – EA should place

SELL LIMIT orders on an AVERAGE, but price broke through the indicated average. On the other side price has spent enough time, as

specified in the parameter of number of candles that have to close after average crossing. When this parameter is met, EA will place a BUY

LIMIT with adjusted SL, BE, TP levels` distances.

Places pending orders with fixed lots value or – if parameter left with zero – with lots calculated upon a risk factor – a percentage of capital

risked on a total SL distance. (E.g. – for a trading account of 10 000 USD a pending order of 5% over 100 points and of 1% over 500 points will

have the same lot value.) Note that when using a risk factor YOU FOCUS ON RISK MANAGEMENT, NOT ON LOT MANAGEMENT. When your account

grows, all you have to do is switch off the EA, cancel all orders and switch the EA on – TA DA – same order types, same places BUT new lot

calculation for ALL orders. This is A VERY TIME SAVING option.

EA can handle more than one order on one average. Next order on specified average will be placed after given number of candles has passed

after activation of the previous order. So it is possible to have more than one order placed on one average if TP was far away enough to give

space for the previous, activated, order to work. If enough candles are closed after first activation, the second order is placed – now

EA manages two orders and it can iterate on and on.

EA moves SL to BE only once. If user would move SL before BE distance occurs, EA will not manage BE anymore. The same is with TP – if user will

move it, EA won`t move it back.

Opts:

Risk – percent lots value

fixedLots – fixed lots value

robotName – user defined name of EA

avgOptions – header for average parameters

barsForAvg – specified by user number of candles that the average is calculated on

avgMethod – user can choose average method from: simple, exponential, smoothed and linerWeighted

avgPrice – user can choose price that is taken for calculations from: open, high, low, close, HL/2, HLC/3, HLCC/4

s1Options – header for s1 indicator parameters; at some point I wanted to use this indicator as a line to place limit

orders as well. If you do not have this

indicator, than this option will not be of any use.

t3Period – default value that I use

t3Price – default value that I use

b – default value that I use

line0 – header for order parameters

op0 – select an order type – user can choose only a BUY or SELL LIMIT, STOP orders are inactive

startOffset0 – starting offset – distance from the average; this value is changed for the opposite automatically when

EA places order after average price

crossing. For example – a +20 points offset for BUY LIMIT will result in -20 offset for SELL LIMIT; a -20 offset for

BUY LIMIT will result in +20

offset for SELL LIMIT

lineWidth0 – user can specify a maximal distance between the price and the average that will allow EA to work – if price

will be above this distance – EA

will not place a pending order

tp0 – take price distance from activation price

distSL0 – stop loss distance from activation price

distBE0 – break even distance from activation price

waitBarsAfterActivation0 – number of candles that EA will wait before placing next pending order after activation of

previous one

nMaxOpenOrders – how many orders EA is allowed to manage.

autoFlip0 – true / false

waitBarsAfterCrossingAvg0 – number of candles that EA will wait before placing pending order after price crossed the average

![图片[1]-Mql5官网 Pending on Average 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240520095557-664b1e2dba4b7.png)