This indicator is based on multiple instances of CCFpExtra cluster indicator and provides superposition

of their results.

The indicator creates a set of CCFpExtra

instances with carefully selected periods and combines their results using smart weighting and normalization algorithms. No more

worries about settings to choose for cluster analysis, no more false signals. And it inherits all advantages of

CCFpExtra: arbitrary groups of tickers or currencies, time

alignment of bars for different symbols with proper handling of possibly missing bars, up to 30 instruments.

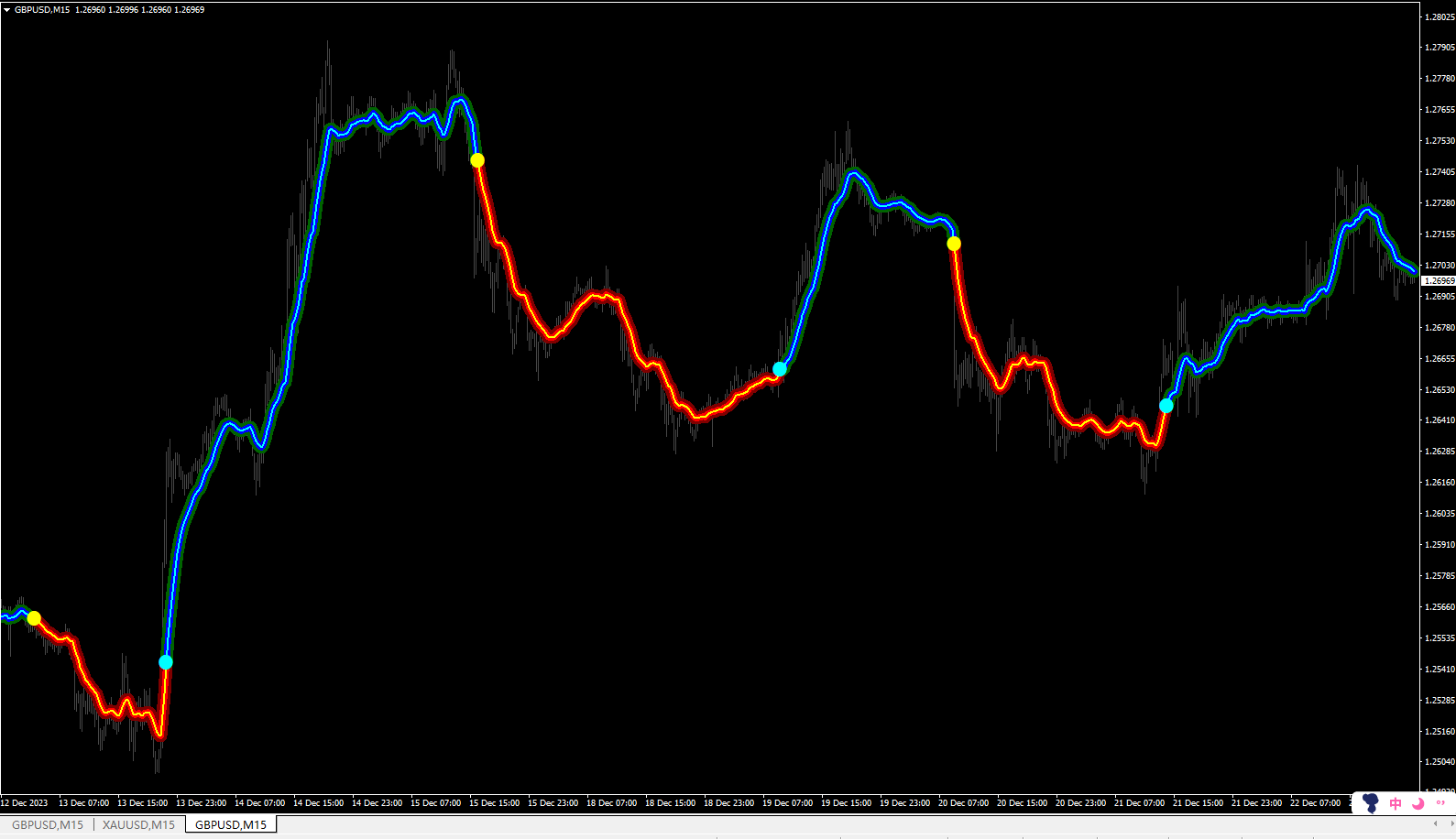

The indicator works in a similar way as CCFpExtra

– it shows up to 8 lines with relative power of each given symbol. In fact they are signals: the higher currency the stronger signal to buy it, the

lower currency the stronger signal to sell it, and most reliable instruction is: what is at the top should be bought, and what is at the bottom

should be sold. But unlike to CCFpExtra, CCFpExtraSuperMulti never implies overbought or oversold states, so

if you usually treat clusters in such a way that upper symbol is overbought and you should sell it – don’t do it, and similarly if you used to

treat lower symbol as oversold and good target for buying – don’t do it either.

The recommended timeframes H1 – D1.

Parameters:

- Instruments – comma separated list of instruments with a common currency; for Forex symbols the common currency is either a

quote currency or a base currency, which is detected in all given symbols; if the autodetection failed (as for non-Forex

tickers),DefaultBase parameter is used (here, ‘base’ means a common currency between all tickers, not a base currency of a Forex symbol); the

default set of instruments includes all Forex majorsEURUSD,GBPUSD,USDCHF,USDJPY,AUDUSD,USDCAD,NZDUSD; please note, that NZDUSD can be missing at some demo servers, so don’t

forget to edit as appropriate; - MA_Method – moving average method, the default is linear weighted;

- Price – moving average applied price type, the default is weighted price;

- All_Bars – number of bars to calculate on, the default – 1000; 0 means all available bars (do not

recommended); - BarByBar – false means re-calculating 0-th bar on every tick, true (default)

means calculating bar only once (on 1-st tick and when closed); - DefaultBase – default common currency to use; it’s used only if the base can not be detected automatically.

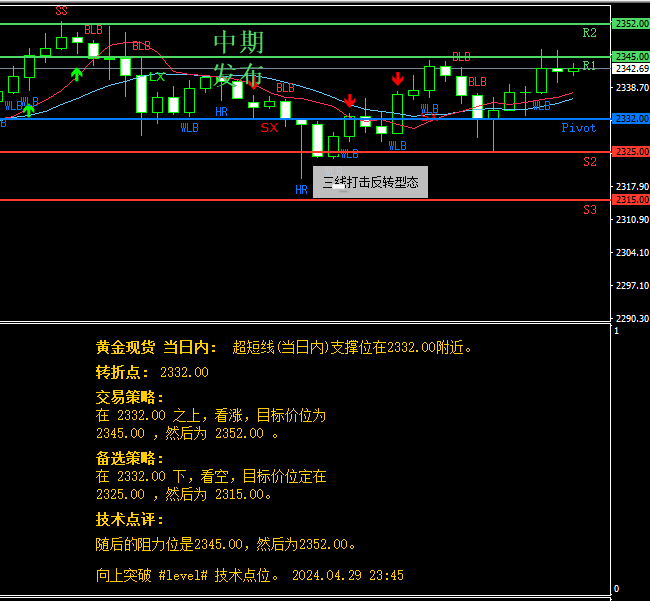

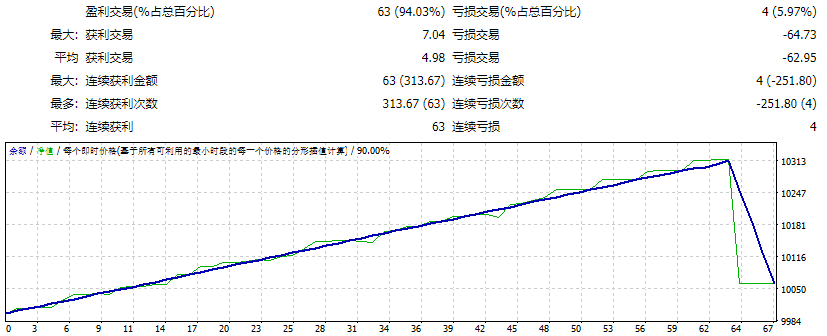

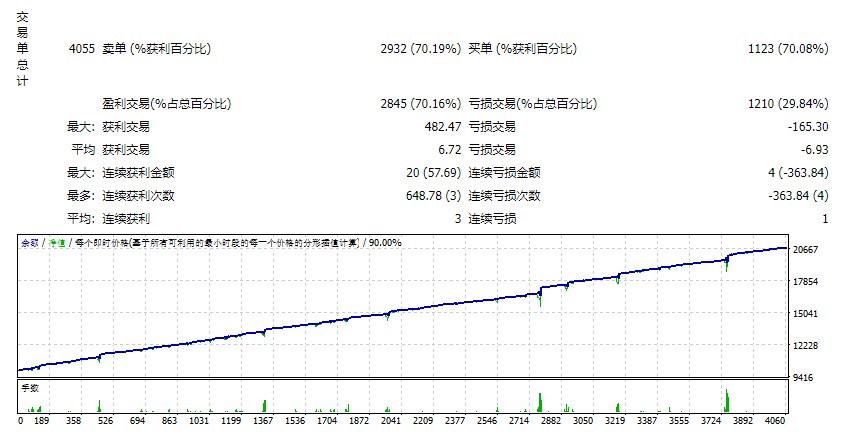

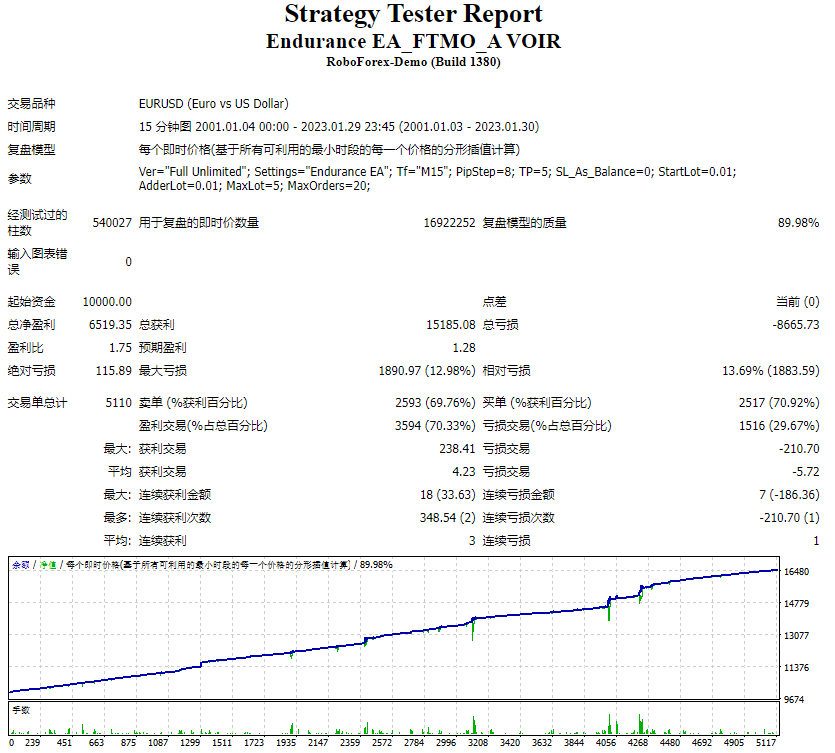

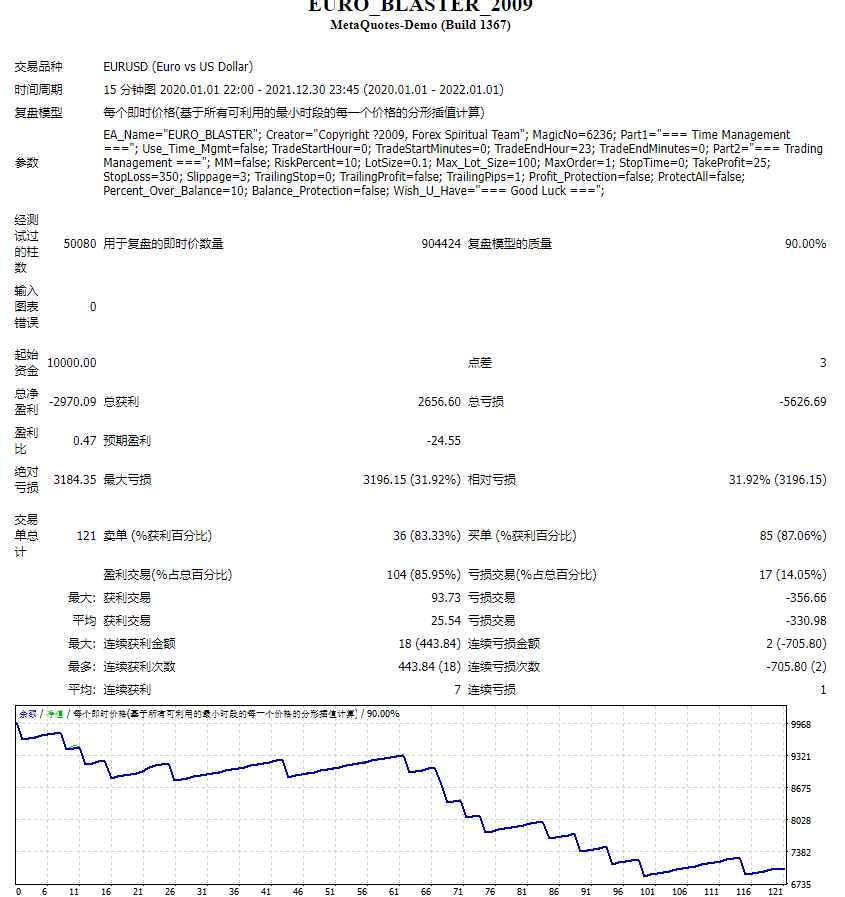

The screenshots 1-4 show trading opportunities for major Forex currencies chronologically (though not all of them), using H1. The

screenshot 5 shows long-term trading opportunities on EURJPY D1 in past.

More functionality is provided by the successor indicator SuperIndices.

![图片[1]-Mql5官网 CCFpExtraSuperMulti 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240521030942-664c10762228a.gif)

![图片[2]-Mql5官网 CCFpExtraSuperMulti 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240521030942-664c1076ab7e4.gif)

![图片[3]-Mql5官网 CCFpExtraSuperMulti 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240521030943-664c1077441f1.gif)

![图片[4]-Mql5官网 CCFpExtraSuperMulti 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240521030944-664c10781c250.gif)