Double Exponential Moving Average (DEMA) is a moving average (MA) that gives the most weight to recent price data.Like exponential moving average (EMA), it is more reactive to all price fluctuations than

a simple moving average (SMA) and so DEMA can help traders to spot reversals

sooner, because it is faster

responding to any changes in market activity.

DEMA was developed by Patrick Mulloy in an attempt to reduce the

amount of lag time found in traditional MAs. (TASC_Feb. 1994).

DEMA can also be used as a component in a lot of indicators like

Moving Average Convergence Divergence (MACD) and Triple Exponential Moving

Average (TRIX) that are based on MA types and can be modified to use a DEMA

instead of other more traditional types of MAs.

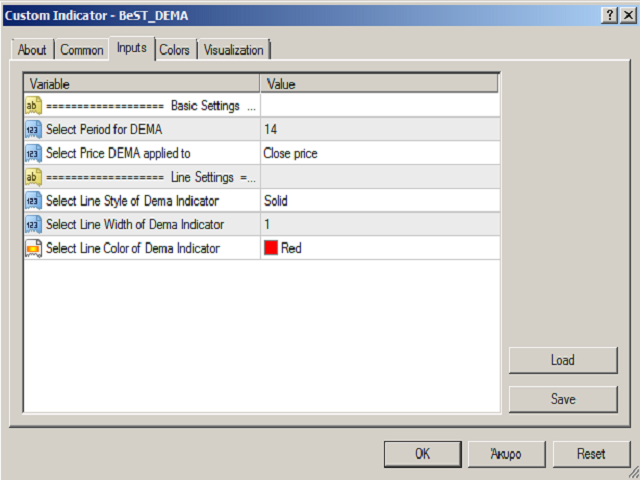

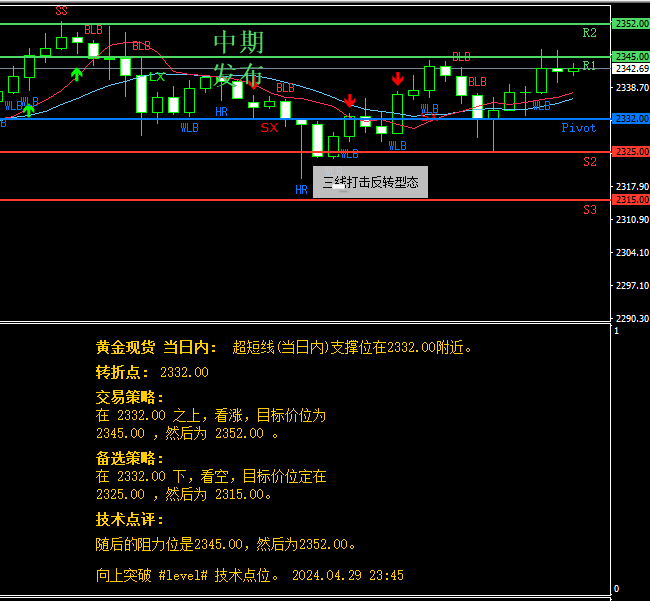

Inputs

Basic Settings

- Select Period

for DEMA: It is the

number of Bars that we Look Back on the Chart in order to calculate DEMA. - Select Price

DEMA applied to: It is the price

we use in DEMA calculation. By default we use the price of Close.

Line Settings

- Select Line Style of Dema Indicator

- Select Line Width of Dema Indicator

- Select Line Color of Dema Indicator

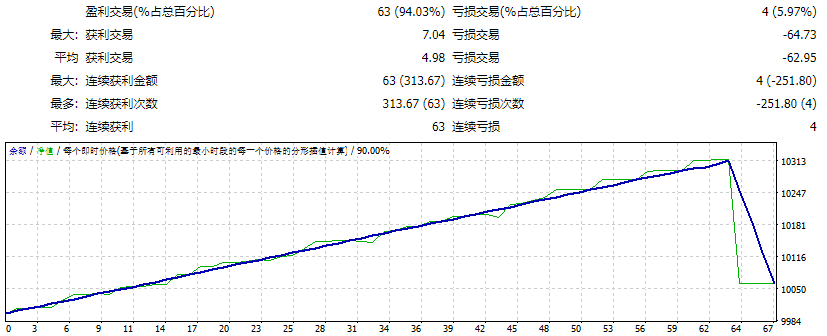

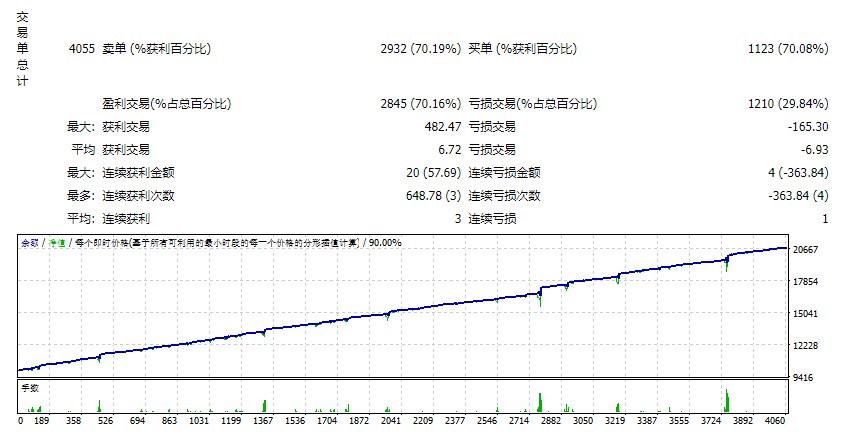

![图片[1]-BeST DEMA 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240514131547-664364032ef52.png)