Please download the demo and try this out!

LAUNCH PROMO:

- Only a few copies left at current price!

- Final price: 990$

【About TOKYO NAKANE FIX】

Overview:

This EA utilizes a trading logic specific to the currency pair USD/JPY, known as Nakane Trading.

“Nakane” refers to the rate that serves as the benchmark for financial institutions engaged in foreign exchange transactions, determined daily at 9:55 AM(Japanese Standard Time).

Importing companies often place buy orders for USD around this time to secure funds for settlements, creating a tendency for the rate to generally rise.

Nakane Trading is a strategy that utilizes on this tendency by taking a long position on USD/JPY before 9:55 AM(JST) and a short position exactly at 9:55 AM(JST) to aim for profits.

Nakane Trading is a well-known logic in Japan, however, due to its nature of conducting standardized trades, tends to struggle with flexible responses to market conditions. This EA has combined its own unique logic with Nakane Trading, enhancing it to take positions only when there is a high probability of winning based on the current market conditions.

This EA enters into a long position before the start of a new day, allowing for the possibility of earning swap points upon the rollover. Originally, the Nakane Trading method has its advantages, and aiming to earn swap points adds another layer, allowing for highly reliable trading.

This EA has with two types of logics for taking long positions and one type of logic for taking short positions.

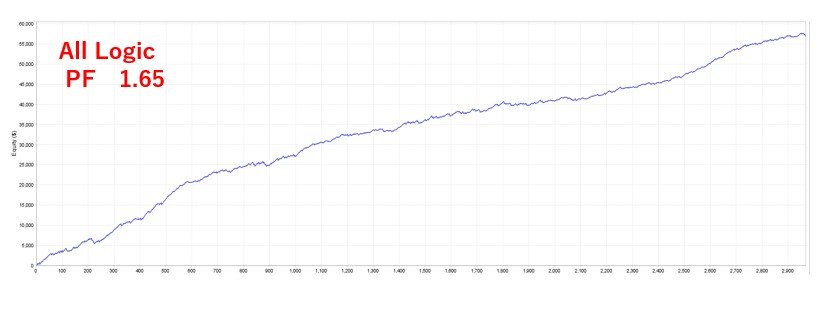

By default, all three logics are set active, and it is recommended to keep them all active. Combining these three logics allows them to complement each other, accumulating profits.

The combined backtesting results for all three logics show a Profit Factor of 1.57, assuming zero swap points. With a 3% swap point rate, the Profit Factor increases to 1.81, and at a 5% swap point rate, it further improves to 2.03.

Please refer to the screenshots for the results of the backtests for each logic.

This strategy can generate profits even under the assumption of zero swap points. However, since the size of swap points can significantly impact the results, it’s essential to consider a balance with spreads. Please, whenever possible, use a broker with larger swap points while taking into account the balance with spreads.

The backtests for all scenarios are conducted using Tick Data Suite and cover a period of 15 years from 2009.

Please use this EA in a zero-commission account(like STP). If your account is a commission-based account(like ECN), there is a possibility that the performance may not be equivalent to that of a zero-commission account. If you prefer to use in a commission-based account, please adjust the TP (Take Profit) values accordingly.

【How to Use】

Currency Pair:

- USD/JPY

Timeframe:

- 1 Hour (1H) Please ensure to use the 1-hour timeframe.

Parameters:

- MagicNumber: Set a suitable number of your choice. Be careful not to duplicate this MagicNumber with those of other EAs.

- Lots: Lot size. Set according to your available capital.

- Slippage: Permissible slippage. Adjust as needed.

- MM (Money Management): On/Off for compounding.

- Risk: Compounding interest rate.

- Buy1: If you use the Buy1 strategy, set “true”.

- Buy2: If you use the Buy2 strategy, set “true”.

- Sell: If you use the Sell strategy, set “true”.

- Buy1TP: = TakeProfit pips of Buy1. It is recommended to set it at 7 pips.

- Buy1SL = StopLoss Pips of Buy1. It is recommended to set it at -40 pips.

- Buy2TP = TakeProfit pips of Buy2. It is recommended to set it at 7 pips.

- Buy2SL = StopLoss Pips of Buy2. It is recommended to set it at -40 pips.

- SellTP = TakeProfit pips of Sell. It is recommended to set it at 12 pips.

- SellSL = StopLoss Pips of Sell. It is recommended to set it at -40 pips.

- Buy1_Entry_StartTime_StandardTime: Entry start time of Buy1 during U.S. standard time. For GMT+2/3, use the default “22:00”.

- Buy1_Entry_EndTime_StandardTime: Entry end time of Buy1 during U.S. standard time. For GMT+2/3, use the default “22:01”.

- Buy1_Entry_StartTime_SummerTime: Entry start time of Buy1 during U.S. summer time. For GMT+2/3, use the default “23:00”.

- Buy1_Entry_EndTime_SummerTime: Entry end time of Buy1 during U.S. summer time. For GMT+2/3, use the default “23:01”.

- Buy2_Entry_StartTime_StandardTime: Entry start time of Buy2 during U.S. standard time. For GMT+2/3, use the default “21:58”.

- Buy2_Entry_EndTime_StandardTime: Entry end time of Buy2 during U.S. standard time. For GMT+2/3, use the default “22:59”.

- Buy2_Entry_StartTime_SummerTime: Entry start time of Buy2 during U.S. summer time. For GMT+2/3, use the default “22:58”.

- Buy2_Entry_EndTime_SummerTime: Entry end time of Buy2 during U.S. summer time. For GMT+2/3, use the default “23:59”.

- Sell_Entry_StartTime_StandardTime: Entry start time of Sell during U.S. standard time. For GMT+2/3, use the default “02:55”.

- Sell_Entry_EndTime_StandardTime: Entry end time of Sell during U.S. standard time. For GMT+2/3, use the default “02:56”.

- Sell_Entry_StartTime_SummerTime: Entry start time of Sell during U.S. summer time. For GMT+2/3, use the default “03:55“.

- Sell_Entry_EndTime_SummerTime: Entry end time of Sell during U.S. summer time. For GMT+2/3, use the default “03:56“.

- Buy1_Close_StartTime_StandardTime: Close start time of Buy1 during U.S. standard time. For GMT+2/3, use the default “02:55”.

- Buy1_Close_EndTime_StandardTime: Close end time of Buy1 during U.S. standard time. For GMT+2/3, use the default “02:56“.

- Buy1_Close_StartTime_SummerTime: Close start time of Buy1 during U.S. summer time. For GMT+2/3, use the default “03:55“.

- Buy1_Close_EndTime_SummerTime: Close end time of Buy1 during U.S. summer time. For GMT+2/3, use the default “03:56“.

- Buy2_Close_StartTime_StandardTime: Close start time of Buy2 during U.S. standard time. For GMT+2/3, use the default “02:55“.

- Buy2_Close_EndTime_StandardTime: Close end time of Buy2 during U.S. standard time. For GMT+2/3, use the default “02:56“.

- Buy2_Close_StartTime_SummerTime: Close start time of Buy2 during U.S. standard time. For GMT+2/3, use the default “03:55”.

- Buy2_Close_EndTime_SummerTime: Close end time of Buy2 during U.S. standard time. For GMT+2/3, use the default “03:56”.

- Sell_Close_StartTime_StandardTime: Close start time of Sell during U.S. standard time. For GMT+2/3, use the default “04:20”.

- Sell_Close_EndTime_StandardTime: Close end time of Sell during U.S. standard time. For GMT+2/3, use the default “04:21”.

- Sell_Close_StartTime_SummerTime: Close start time of Sell during U.S. standard time. For GMT+2/3, use the default “05:20”.

- Sell_Close_EndTime_SummerTime: Close end time of Sell during U.S. standard time. For GMT+2/3, use the default “05:21”.

![图片[1]-Tokyo Nakane FX 外汇EA-EA侦探社 - 全球领先的MQL5官网外汇EA机器人MT4自动化交易EA资源免费分享网站](https://www.mql5.vip/wp-content/uploads/2024/05/20240514203104-6643ca08649bb.jpg)